Nevada faces a serious wildfire risk. Many people are losing their home insurance. This is due to increased fire danger in the state. Lawmakers are taking action to help.

- New laws aim to protect homeowners from sudden cancellations.

- They want to make it easier for people to get coverage.

- Officials are also looking at ways to improve fire safety.

These efforts are important to keep homes safe and insured.

Nevada’s Growing Home Insurance Crisis Due to Wildfire Risk

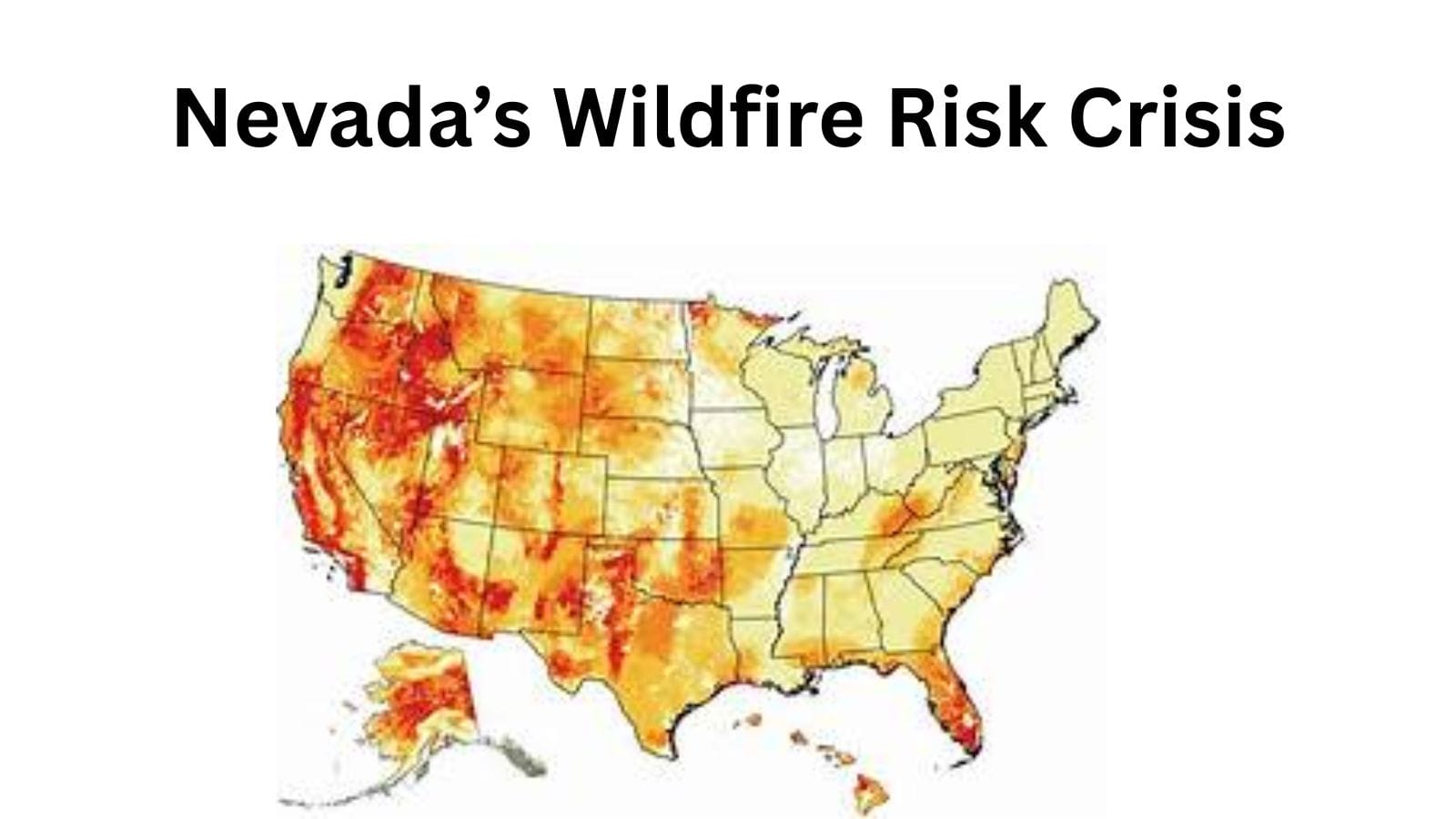

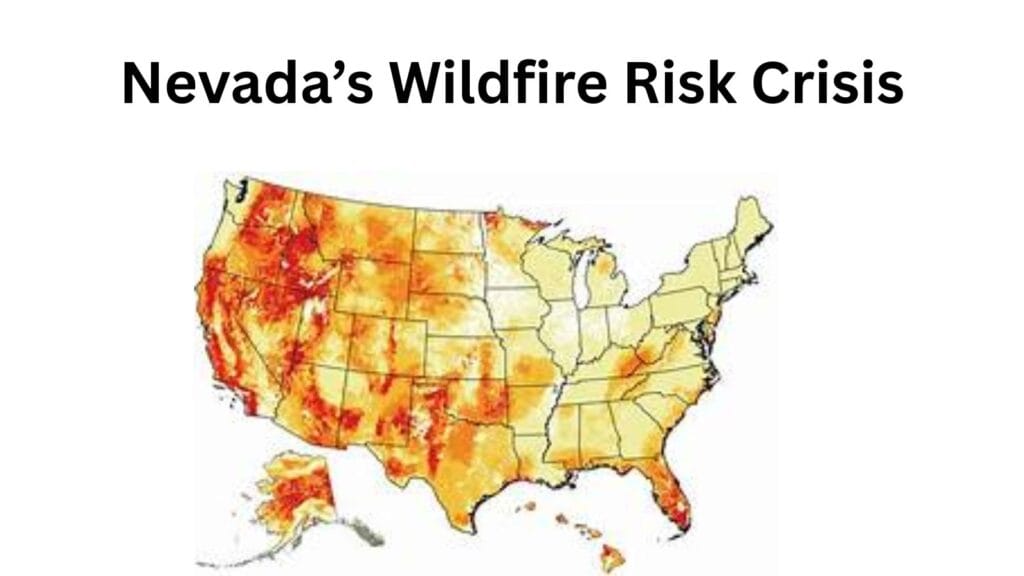

Wildfires are a growing problem in the United States, especially in Nevada. This change is due to the growing threat of wildfires. This issue worries residents, insurance companies, and lawmakers. They all fear a potential crisis.

In response, Nevada lawmakers have introduced two critical bills to address the growing problem. The primary aim is to ensure that homeowners can access affordable insurance even in high-risk wildfire areas. Assembly Bill 437 (AB437) and Assembly Bill 376 (AB376) are gaining support in the Nevada State Legislature. They provide solutions to the wildfire insurance crisis.

This article will look at the bills, their effects on Nevada residents, and how they aim to help homeowners deal with wildfires. We’ll show real-time examples, share fun facts, and discuss what this means for the insurance industry and homeowners in Nevada.

The Growing Wildfire Risk in Nevada

Nevada has long been susceptible to wildfires, but recent years have seen a marked increase in the frequency and severity of these fires. The Lied Center for Real Estate at the University of Nevada, Las Vegas, reports that over 18% of Nevada’s land has burned in wildfires in the last 40 years. This includes vast rural areas in the northern part of the state, such as Elko County, which has seen 41% of its land burned by fire.

Wildfires are growing more destructive. Prolonged droughts and rising temperatures fuel these fires. They harm both the environment and human infrastructure. In 2023, the Davis Fire burned 5,824 acres near Reno. It forced thousands of residents to evacuate and destroyed many homes and businesses.

Fun Fact: Nevada ranks as the fifth state in the U.S. for land burned by wildfires over the past four decades. The rise in wildfire incidents has made the insurance market in the state particularly volatile.

The impact on homeowners is particularly severe. Wildfires are happening more often. Because of this, insurance companies are less willing to cover people in high-risk areas. This has caused cancellations and non-renewals of home insurance policies. Homeowners are now vulnerable and have no options. In 2023, 481 homeowners insurance policies were canceled. This was an 82% increase from last year. Also, nearly 5,000 homeowners insurance applications were denied because of wildfire risks. This marked a 104.8% rise.

The Legislative Response: Assembly Bill 437 (AB437)

The FAIR Plan – A Lifeline for Homeowners

To address the growing issue of insurance cancellations, Republican Assemblymember Jill Dickman from Washoe County has introduced Assembly Bill 437 (AB437). This bill seeks to establish a Fair Access to Insurance Requirements (FAIR) Plan in Nevada. The FAIR plan is a “last-resort” insurance option. It helps homeowners who can’t get coverage from regular insurance providers. This often happens because of their location or wildfire risk.

This is not a new concept—FAIR Plans have been in place since the 1960s and are currently available in 34 states and the District of Columbia. State governments manage these plans. However, private insurers fund them. This way, the financial burden is shared among different parties.

In Nevada, AB437 would make FAIR insurance available to homeowners who have been rejected by at least three private insurers. Homeowners must get a wildfire risk assessment. They should also follow the recommendations to lower the risk to their property. The bill aims to ensure that the FAIR program remains a “market of last resort” and does not compete with private insurers.

Real-Time Example: In Elko County, many homes have burned in wildfires. Because of this, homeowners are finding it harder to get insurance. The FAIR Plan can help these residents. It offers a safety net, so they can keep property protection as wildfire risks grow.

The Caps on Coverage

The FAIR Plan under AB437 will offer coverage up to $5 million for commercial properties and $750,000 for residential properties. While these caps may seem low given the rising cost of homes in Nevada, Dickman argues that this is a necessary starting point. The median home price in Washoe County is around $550,000. So, the $750,000 cap might not cover pricier homes, but it still helps most homeowners in the state.

Addressing Industry Concerns: Assembly Bill 376 (AB376)

AB437 aims to create a last-resort insurance plan. In contrast, Assembly Bill 376 (AB376), from Republican Assemblymember P.K. O’Neill, suggests a different solution. AB376 would set up a “regulatory sandbox” for insurance companies. This lets them try out new types of insurance products, even if they don’t fit current state rules. The goal is to boost innovation and flexibility in insurance. This could lead to cheaper coverage options.

Lawmakers want insurers to try new products without strict regulations. This way, they can offer better solutions for homeowners.

Industry Concerns:

Critics of AB376, such as the Consumer Federation of America, fear that the sandbox could lead insurers to stop offering wildfire coverage. This could leave homeowners unprotected. They worry that companies may use the sandbox to skip covering wildfire damage. They could still provide other types of insurance.

The Ongoing Debate: A Call for Immediate Action

Nevada lawmakers are debating these bills. Some stress the urgent need to tackle the wildfire insurance crisis. Assemblymember Jill Dickman has warned that delaying legislative action could exacerbate the problem. She pointed to Colorado, which passed similar legislation in 2023, and is just now starting to implement its FAIR Plan. Dickman stressed that Nevada cannot afford to wait for two more years, as wildfire risk continues to increase.

Critics of the FAIR plan, like the American Property Casualty Insurance Association (APCIA), argue that we must tackle the root causes of the crisis. This includes the growing number and severity of wildfires. They believe that merely creating a FAIR Plan won’t solve the core issues and that other forms of innovation are needed.

Implications for Nevada Homeowners and the Insurance Industry

Impact on Homeowners:

- Peace of Mind: Homeowners in Washoe County and Elko County worry more about wildfires. They fear losing their insurance coverage. The FAIR Plan provides a crucial safety net, allowing them to secure coverage even when private insurers refuse to take on the risk.

- Affordability Concerns: The FAIR Plan might not fully cover every home, but it helps homeowners stay insured. This way, they can avoid the serious financial risks that come with wildfires.

Impact on the Insurance Industry:

- New Business Models: The regulatory sandbox in AB376 lets insurers try new business models. This could create fresh opportunities for insurers and customers alike. However, some insurers fear that the changes might lead to higher premiums or reduced coverage for wildfire damage.

- Regulatory changes might push insurers to create new products. However, these innovations need careful evaluation. This ensures they give homeowners the protection they need.

Conclusion: What’s Next for Nevada’s Homeowners and Insurance Industry?

Nevada’s ongoing wildfire risk crisis is pushing state lawmakers to take action. AB437 and AB376 are important for helping homeowners in high-risk areas get insurance. FAIR Plans provide crucial support for people who can’t find coverage. Meanwhile, regulatory sandboxes help the insurance industry create new solutions. These solutions aim to tackle wildfire risks and keep costs affordable.

Wildfires are affecting Nevada and other states. It’s important for lawmakers, insurers, and homeowners to team up. Together, they can find lasting solutions. The success of these laws will rely on balancing market stability, affordability, and coverage. This is especially important for residents impacted by the increasing wildfire threat.

The Latest Updates in the Insurance Industry in 2025

FAQs

The FAIR Plan is a state-run insurance program. It helps homeowners who can’t get insurance from private companies, usually because of high wildfire risk.

AB437 creates the FAIR Plan in Nevada. It provides homeowners insurance as a backup for those who can’t get coverage from three private insurers. It also requires homeowners to implement wildfire mitigation measures.

A regulatory sandbox lets insurance companies try out new products and business models. They can do this without following all the current rules. It encourages innovation in coverage options.

Wildfires are happening more often and getting stronger because of climate change. So, insurers are raising premiums or canceling policies in high-risk areas to protect their finances.

To qualify for the FAIR Plan under AB437, homeowners need to be denied coverage by three private insurers. They also must complete a wildfire risk assessment.