Overview

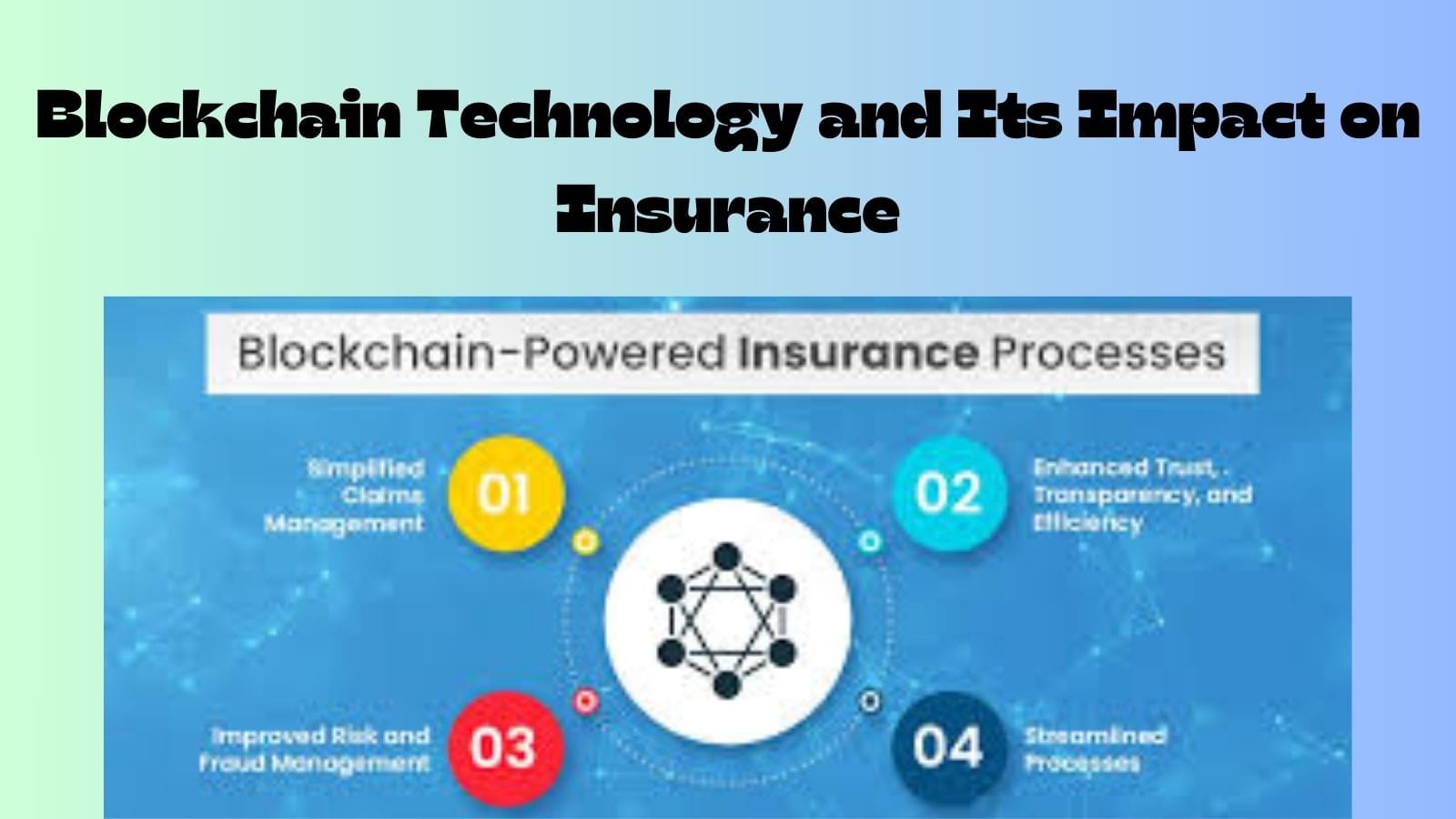

The insurance industry, once seen as a trusted field, is changing fast. Blockchain technology is at the forefront of this shift. Blockchain is a decentralized ledger technology. It supports cryptocurrencies like Bitcoin. This technology helps industries that need secure data. It also boosts transparency and efficiency. Blockchain can transform insurance. It tackles major issues like fraud, slow claims, and a lack of transparency. It also simplifies complicated reinsurance processes. Using blockchain can help the insurance industry become more automated, trustworthy, and cost-effective.

In this article, we’ll explore how blockchain technology is poised to revolutionize the insurance landscape.

We’ll talk about its uses, like:

- Smart contracts for automating claims

- Decentralized insurance models

- Blockchain’s unchangeable ledger to prevent fraud

- Streamlining reinsurance

We’ll share real-world examples, interesting stories, and fun facts. We’ll also discuss challenges and the future of blockchain in insurance.

Smart Contracts for Automating Claims

What Are Smart Contracts?

A smart contract is a self-executing contract with the terms of the agreement directly written into lines of code. It runs on a blockchain, which means that once deployed, it is secure, transparent, and immutable. The main benefit of smart contracts in insurance is automation. When specific conditions are met, the contract automatically carries out actions. This can include making payments or starting claims processes.

In traditional insurance, claims processing involves multiple intermediaries, paperwork, and verification steps. This can delay settlements and lead to higher administrative costs. Smart contracts on blockchain process claims automatically when conditions are met. This makes handling faster, clearer, and free of errors.

Real-World Example: Etherisc and Flight Delay Insurance

Etherisc is a decentralized insurance protocol. It uses smart contracts on the blockchain to automate flight delay insurance. In the traditional system, travelers would need to submit claims after a flight delay, often waiting days for approval. With Etherisc, the smart contract pays the policyholder right after a flight delay is confirmed. This removes middlemen and speeds up how quickly customers get their money.

This approach speeds up claims and lowers costs linked to human work, paperwork, and fraud. Blockchain-driven automation settles claims quickly and fairly. This leads to a better customer experience.

Decentralized Insurance Models

A key feature of blockchain technology is decentralization. In a traditional insurance model, an insurance company acts as a trusted middleman for policyholders. However, blockchain enables decentralized insurance models where no single entity holds complete control.

What Is Decentralized Insurance?

Decentralized insurance eliminates the need for traditional insurance companies. It uses blockchain to enable peer-to-peer (P2P) transactions. Smart contracts, dApps, and blockchain protocols let customers create insurance pools. They can share risk and manage claims together. This process does not depend on a central authority. This model can significantly reduce costs and improve efficiency.

Real-World Example: Nexus Mutual

Nexus Mutual is a decentralized insurance platform on the blockchain. It lets users pool their money to protect one another. This helps cover risks like smart contract failures and other blockchain-related issues. Members contribute to a mutual pool instead of paying premiums to a central insurance company. Then, claims are handled through decentralized governance.

Nexus Mutual uses blockchain to cut out intermediaries. This creates a transparent system where users control claims handling. This results in lower fees, a faster claims process, and greater trust between policyholders.

Reducing Fraud Through Blockchain’s Immutable Ledger

Blockchain’s most significant advantage is its immutable ledger. Once data is recorded on a blockchain, it cannot be altered or deleted without the consensus of the network participants. This makes it ideal for preventing fraud, a persistent issue in the insurance industry.

How Blockchain Reduces Fraud

Fraudulent claims and policy manipulation are major concerns for insurers. In many cases, policyholders may alter or misrepresent their data to receive a higher payout. Blockchain’s clear and unchangeable ledger records every transaction. This record lasts forever. After a claim is submitted and checked, it goes on the blockchain. This makes it unchangeable, which helps keep it real and cuts down on fraud.

Blockchain also allows for easier verification of the legitimacy of claims. In health insurance, blockchain stores medical records. This lets us check their authenticity. So, it helps prevent fraud for treatments that never happened. In auto insurance, blockchain tracks vehicle history and accident reports. This ensures claims are verified with accurate and unaltered data.

Real-World Example: The B3i Blockchain Initiative

The B3i (Blockchain Insurance Industry Initiative) is a group of global insurance and reinsurance firms. They are working together to see how blockchain can boost efficiency and cut down on fraud. They are creating a decentralized platform that connects insurance companies, brokers, and clients. Blockchain’s unchangeable ledger makes sure that all transactions can be verified. It offers transparency and is hard to tamper with.

The B3i initiative lowers fraudulent claims and also streamlines reinsurance. It allows automatic data sharing, cuts down on paperwork, and makes contracts simpler.

The Potential for Blockchain to Streamline Reinsurance

Reinsurance is when insurance companies buy policies from other insurers. They do this to manage their risk. It’s a complicated process with lots of paperwork. Many parties are involved. Blockchain can make this process faster. It offers a clear, unchangeable, and effective way to manage reinsurance contracts.

How Blockchain Can Streamline Reinsurance

Blockchain makes reinsurance transactions secure. This cuts down on paperwork and saves on administrative costs. Smart contracts can trigger reinsurance claims automatically. They do this based on set conditions. This cuts down on manual work and speeds up settlement times. Blockchain allows insurers, reinsurers, and others to share data easily. This boosts the speed and accuracy of transactions.

Additionally, the transparency provided by blockchain can help reduce the complexity of reinsurance agreements. All transactions and contracts are on a secure ledger. This lets everyone see the terms of reinsurance agreements clearly. As a result, it helps avoid disputes about coverage or payout amounts.

Real-World Example: Swiss Re and the Blockchain Pilot Project

Swiss Re, one of the world’s largest reinsurers, has been exploring the use of blockchain to improve reinsurance processes. The company is starting a pilot project. It will use blockchain to share data in real-time between insurers and reinsurers. This project aims to automate the exchange of claims data, streamline contract management, and improve transparency.

Swiss Re’s use of blockchain can cut administrative costs. It also boosts efficiency in reinsurance. This leads to savings and builds trust between parties.

Conclusion

Blockchain technology is changing the insurance industry in big ways. It offers benefits like better transparency, quicker claims processing, less fraud, and smoother reinsurance processes. Blockchain is solving many problems for insurers and policyholders. It does this by automating claims with smart contracts. It also enables decentralized insurance models and uses an unchangeable ledger.

As we move toward a more digitized future, blockchain’s role in insurance will only continue to grow. Widespread blockchain use in insurance requires teamwork. Stakeholders must collaborate. There’s also a need for regulatory changes and continuous innovation. Blockchain has great potential to change insurance. It can make the industry more efficient, transparent, and friendly for customers.

The Role of Artificial Intelligence in Predictive Analytics for Insurance

FAQs

Smart contracts make claims easier. They run set actions when specific conditions are met. This cuts down on middlemen, speeds up claim settlements, and makes sure claims are handled openly and fairly.

Decentralized insurance eliminates the need for a central authority. It uses blockchain to enable peer-to-peer transactions. Policyholders add to a shared pool. Claims are handled with decentralized governance, which cuts costs and boosts transparency.

Blockchain’s unchangeable ledger means that once a claim is logged, it can’t be changed or removed. This helps cut down on fraudulent claims. It also makes it easier to verify data, such as medical records or vehicle history, to ensure the legitimacy of claims.

Blockchain makes the reinsurance process easier. It reduces paperwork, automates claims using smart contracts, and increases transparency between insurers and reinsurers. This results in faster transactions, lower administrative costs, and increased trust.

Here are some examples:

Etherisc offers flight delay insurance with smart contracts.

Nexus Mutual has a decentralized insurance model.

Swiss Re is testing a blockchain project to improve reinsurance processes.

These projects are revolutionizing the insurance industry by increasing efficiency and transparency.

Blockchain in insurance brings a new era. We will see greater efficiency, lower costs, and improved customer trust. Blockchain technology can change the insurance sector. It offers secure, automated, and clear systems. This benefits both providers and consumers.